As a fellow Canadian, one of the most frustrating things about ordering from US stores online and shipping internationally are the dreaded surprise bills that you get upon receipt. You could buying something for $100 and your courier will slap you with a bill for another $50. Even worse, sometimes the customs fees are equal to the value of what you bought.

Sound familiar? In purchasing some gifts for travel lovers and stocking up on camping gift ideas, I finally said no to paying the king’s ransom every single time and finally figured out how to avoid paying DHL customs fees in Canada. In speaking to the CBSA, turns out you can do this with pretty much all couriers.

Read more about travel tips and tricks

- How to avoid UPS brokerage fees

- Best Canadian credit cards for travel hackers

- What you need to know about the new Aeroplan program

- How does Travelzoo work?

- Use hotel corporate codes to save money

- What you need to know about the new Amex Aeroplan cards

What are the best ways to save money on travel?

- Latest travel deals – Bookmark the travel deals page which is updated daily.

- Car rentals – Stop getting ripped off and learn about car rental coupon codes.

- Hotels – Use corporate codes or get Genius 2 tier with Booking.

- Flights – Have you ever heard of the “Everywhere” feature?

- Insurance – Make sure you’re covered and learn more about where to buy the best travel insurance.

In This Article

How to Stop Paying Customs Fees to Courier Companies

If you’ve read stories on CBC, and covered by other news outlets, the couriers control the entire workflow of how your packages get from the United States to Canada.

That is reasonable except for the fact that companies ranging from DHL, FedEx, and UPS, have their own arbitrary set of rates that they charge you to help get the packages across the border.

This will often come to you as a surprise bill after the package has been delivered which really sours the experience of making purchases across the border.

So what exactly are the fees that are charged? is there anything you can do to avoid paying DHL customs fees, and those charged by other courier companies?

Breakdown of the type of fees

It’s worth understanding what makes up these fees that couriers like DHL charge when importing goods from the US or other countries.

Taxes

This is the unavoidable charge. For most things that you ship into Canada, they’ll be taxed according to your province’s rate. In Ontario’s case, that’s a 13% HST.

If it’s not HST, it could be GST or any PST on the item’s value.

Duty

Duty is a bit more complicated because it depends on the type of goods you bought and where they came from or where they were made in. Officially, it means having a good understanding of HS Codes and Trade Agreements.

Every item has its own classification and it’s quite the extensive list. Luckily, there is a Canada Tariff Finder where you can find out whether there is duty on a specific type of item.

Generally, if an item is coming from the US, through the Free Trade Agreement (now called CUSMA), there shouldn’t be duty on your purchases.

Exceptions

The exception to the above two fees is that if the value of the item is worth less than $20 CAD, there is no tax or duty according to CBSA (Canada Border Services Agency).

If you’re able to get the seller to mark an item as a gift, there’s an exception of $60 CAD. Anything more than $60, you’ll be responsible for paying taxes for.

Customs Processing Fee/Broker Fee/Brokerage Fee/Clearance Entry Fee

This comes in many names but they’re all the same thing.

When packages come into Canada, they have to clear customs and the courier essentially takes care of it by paying CBSA for you to keep the process moving along.

For handling the customs clearance, and effectively “footing the bill”, the courier will charge a service fee. The thing is, every courier charges something different and some are definitely worse than others.

- DHL: This is called Customs Clearance Customers without DHL Brokerage Account. It is 2.5% of duties and taxes with a minimum of $17.50 CAD. This means it will cost a fixed amount until your taxes/duties exceeds $700 CAD. [See the DHL customs services chart]

- FedEx: This scales based on the value of Duty. Here are the first 5 on the scale with the rest found on the FedEx transportation-related fee table.

- [$40.01 – $60] – $15.45

- [$60.01 – $100] – $19.30

- [$100.01 – $150] – $25.50

- [$200.01 – $500] – $45.35

- [$500.01 – $1,000] – $50.75

- UPS: UPS has a similar fee schedule except its scales worse.

- [$40.01 – $60] – $18.45

- [$60.01 – $100] – $22.00

- [$100.01 – $150] – $29.357

- [$150.01 – $200] – $33.55

- [$200.01 – $350] – $63.15

- [$350.01 to $500] – $70.30

- [500.01 to $750] – $83.75

- It’s worth noting that this is free if you pay for their a UPS Worldwide Express Plus, UPS Worldwide Express, UPS Worldwide Express Freight, UPS Worldwide Express Saver or UPS Worldwide Expedited services.

- USPS/Canada Post: They actually don’t charge customs fees. They just pass along the tax and duty fees which is what makes them a better option for large purchases if speed isn’t a concern.

Note that the above fees are for shipments from the United States to Canada. Also, there’s tax on top of these fees.

If you’re looking specifically to avoid UPS brokerage fees, we’ve written about them too!

Handy calculator

If you’re looking to estimate your duty and taxes, CBSA has a basic calculator that can help give you an idea. The only trouble I had with it is finding the right category for specific items.

How to self clear your own packages

Now that you know a bit more about all the fees surrounding shipments from the US to Canada, how can you actually avoid paying them?

It’s called “self-clearing”. I had this confused with “pre-clearing” at one point but yes, the official term for what you’ll be doing is to self-clearing the package instead of letting the your courier do it for you.

As you learn the steps below, you’ll find out that self-clearing is way easier than you think it is and it’ll help you save a good amount of money.

The frustrating part is that retailers aren’t knowledgeable about this so you really need to figure this out on your own. The good thing is that once you’ve done it once, you’ll know how to handle it for future packages.

The below is a specific DHL example as this is something we had first hand experience with but can be applied to the other couriers.

Step 1: Don’t Pay The DHL Custom Fee or Accept Delivery

With DHL specifically, they are good enough to at least let you know that a duty/tax payment is required. This means that they won’t deliver your package until you’ve paid the import duty/tax and clearance fees.

For most people that don’t know how, you’ll feel like you won’t have a choice but to pay. However, in order for self-clearing to work, you can’t pay the charges and you also can’t accept delivery.

The thing is, once you’ve paid, you’ve contractually accepted the DHL customs fees and there’s no way to reverse it.

If you’re with another courier like FedEx that loves to deliver and then drop the “you owe us money” surprise in the mail later, refuse the delivery if they attempt it.

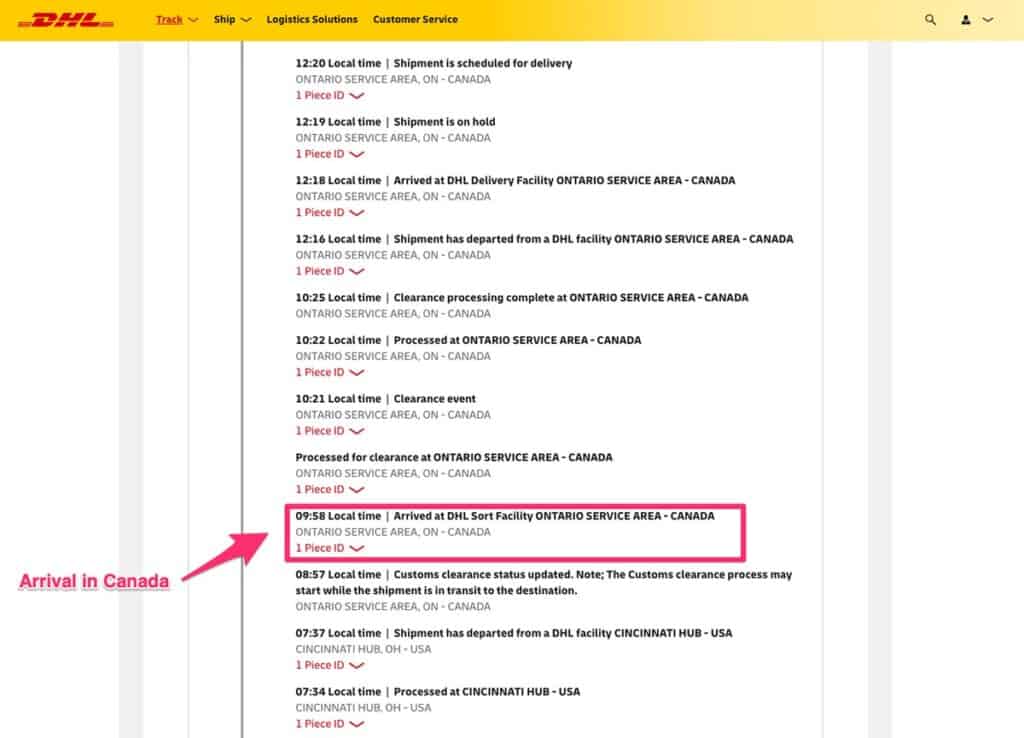

Step 2: Wait Until The Package Has Landed in Canada

You’ll feel like you want to jump the gun immediately after receiving your tracking number but you can’t do anything unless your package has physically landed in Canada and started the clearance process.

Step 3: Call DHL For Documentation

DHL has a self-clearance page which is essentially a contact form but I recommend that you call DHL directly at 1-888-899-0289 (gets to the direct person you will want to speak to) or use the general line at 1-855-345-7447. The reason is because DHL takes a painfully long amount of time to respond.

When you call, let them know you’ll like to self-clear your package. Make sure you have your tracking number. They’ll ask for your e-mail address and they’ll be able to generate the documents you’ll need.

TIP: If you’re asked for a waybill number, that’s the same as your tracking number.

What CBSA is looking for in the document is the text “released under the LVS courier program”.

Where some frustration comes into play is that companies like UPS and DHL will pretend to not know what you’re talking about when you ask about self-clearing. If that happens to you, make sure you continue to pester them and keep calling back.

ALTERNATIVE: We’ve heard from our readers on our UPS brokerage fees article that you could take a gamble and bring the item’s order invoice and a screenshot of the DHL customs fees and the CBSA officer can help sort out the rest. I haven’t tested this personally but thank you for sharing Kari. It’s worth trying if DHL is giving you the run around.

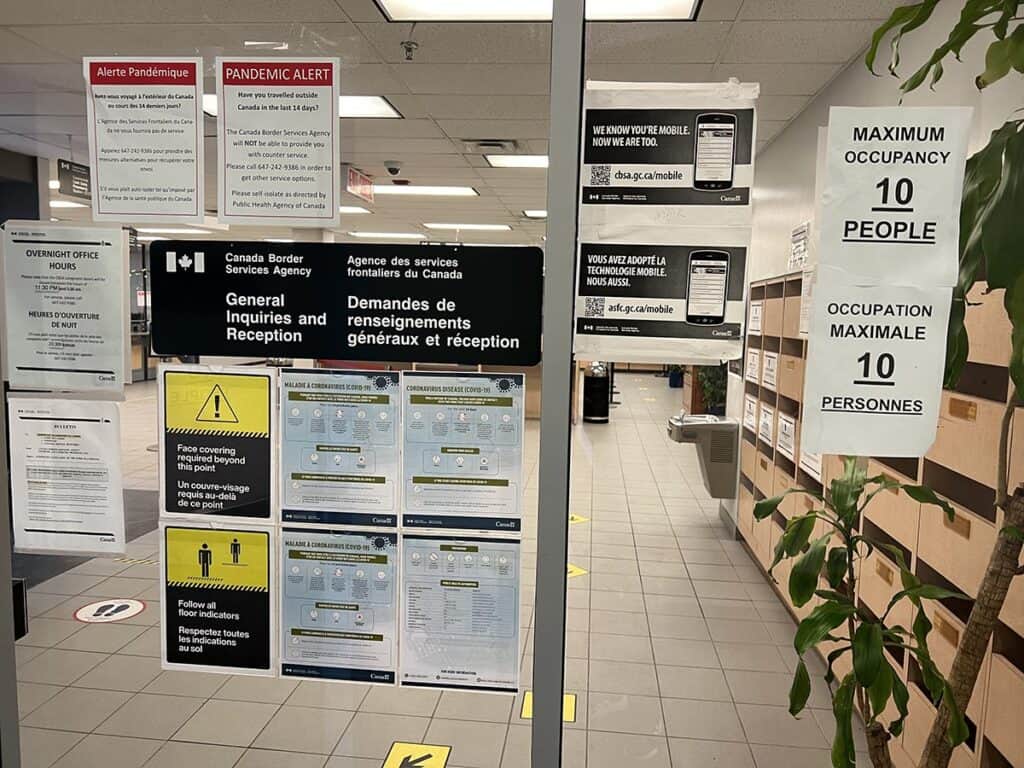

Step 4: Look For Your Closest CBSA Office

This part really tripped us up because all of the guides out there just say “go to the CBSA” office but for the life of me, I couldn’t figure out which one that was.

CBSA has a number of different type of offices but what you’re looking for is the Inland Office. You can use the map or sort the table below by Province and see which one is closest to you.

If you’re in the Toronto area, you’re most likely going to be going to the Toronto Lester B. Pearson International Airport Commercial Operations (2720 Britannia Road East, Mississauga).

If you’re in the Vancouver area, you’ll be going to Vancouver Commercial Operations West (1611 Main Street, Vancouver).

If you’d like to speak to someone at CBSA, you can use call 1-800-461-9999.

Step 5: Visit CBSA to Pay Tax and Duties

Before you head out, make sure you print the documents you received in Step 3. You will also need a piece of ID. Your driver’s license will be sufficient.

The office itself is very clean, organized and spacious. You’ll get in line where there’ll be several CBSA officers ready for you.

What you’ll find is that these CBSA officers are in a way better mood than at the airport so there’s no need to be nervous and feel free to ask a ton of questions.

Handing over the documents, they’ll enter the information into the system and from there, they’ll pass along the paperwork to the cashier.

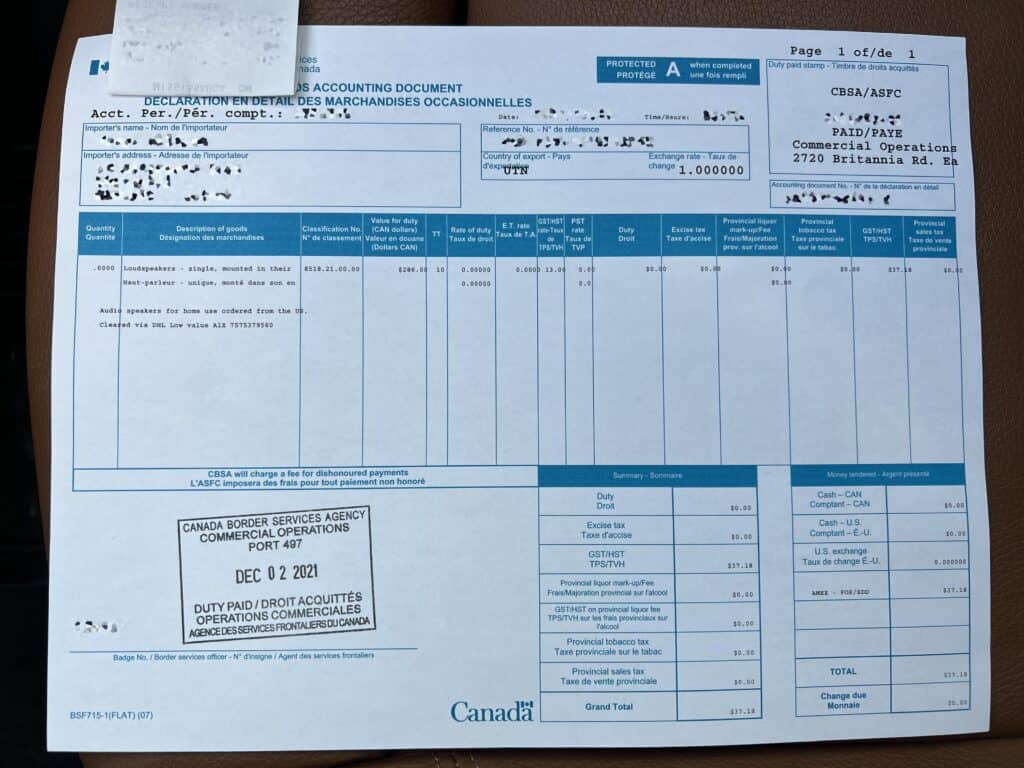

What you will owe are the taxes and duties on the shipment.

The cashier is at a separate booth which is practically next to the officers. Here, you’ll pay the taxes (and duties if owed) and they’ll print out a “Casual Good Accounting Document” with a stamp that says “Duty Paid”.

DHL calls this a “stamped manifest”.

TIP: Yes, they take credit card and American Express is accepted.

Exception: If your package is being held for further inspection, you will need to go to warehouse where it’s being held. In DHL’s case, this is in Hamilton. This is a rare case but could happen if your items have a high risk of being questioned or they are extremely large and expensive shipments.

Step 6: Email Photo of Receipt and Send to Courier

In Step 3, DHL will provide instructions for what to do once the duty/taxes have been paid, including an e-mail address to send this to ([email protected]).

In this e-mail, take a photo of the stamped manifest and let them know the associated tracking number for the package to be released.

You will get an automated response that tells you that they’ll get back to you within 5 days.

If you’re impatient DHL also provides an e-mail address to the team leader ([email protected]) so you could also e-mail them if you’re hoping to speed things up.

They actually got back to me in 24 hours but I noticed according to the tracking that it was put on a truck before I received the e-mail back so I’d say pay closer attention to the tracking details.

How Quickly Do You Need To Self-Clear?

It’s worth highlighting how quickly you need to do this self-clearing process. Do you need to do it immediately or do you have some time to work with?

The answer is yes, you should try to do this as soon as you can but you have a few days to work with.

Yes, you probably want to do this as soon as you can because couriers will not hold your package indefinitely. For customs brokerage specifically, there is a hidden fee called “warehouse storage”. This is applied when packages remain in the warehouse for longer than 2 days.

For UPS, this cost is $20 + $0.04 per lb per day according to their rate guide. For FedEx, this is outlined by their ancillary clearance services which is $0.25 per lb per day. Lastly, DHL provides 3 calendar days before they charge $7.50 + $0.20 per kg per day.

Note that this policy is different from their standard customer vacation hold that companies offer because customs clearance is involved.

How Much Money Do You Save By Self-Clearing?

This really depends on which courier you’re using. In the case of DHL, you’re ultimately saving $17 + tax by self-clearing your own packages.

However, if you’re using FedEx or UPS, you’re most likely saving even more. If your duty is, let’s say $120, you’re saving $25.50 for FedEx and $26.60 for UPS.

The decision you’ll have to make is whether the extra effort and driving time to a CBSA Inland Office is worth it for you. Some will say that the $17 to DHL is worth the convenience, while others will find the rate to be ludicrous. To each’s own!

I think for many of you that attempt it, this is as much of a way to save money as it is a middle finger to DHL, UPS, or FedEx.

Summary of How to Avoid Paying Custom Fees

These broker fees are a scam mainly because couriers make it look like you don’t have a choice or they just don’t give you a choice at all.

To self-clear your package, these are the summary of steps you need to know:

- Don’t pay taxes/duties and if they try to deliver, refuse the package.

- Wait for the package to arrive in Canada.

- Call the courier and let them know you’d like to self-clear. Wait for the required documents via e-mail.

- Find your closest CBSA Inland Office

- At the CBSA office, pay the taxes and duties owed.

- Email the receipt to the courier. They will then release the package for delivery.

Frequently Asked Questions

You will need to do the self-clearing process within 48 hours (FedEx), 2 calendar days (UPS), or 3 calendar days (DHL) to avoid your courier charging you storage fees.

Since the package has taxes/duty associated to it, they won’t release the package for delivery. In the case where they do attempt delivery, they will require a signature. Make sure you refuse the package if you plan on self-clearing.

This depends on the courier that you use. For DHL, you’re saving $17 + tax in most scenarios. For UPS and FedEx, this could save you from $15.45 to $70+.

The only way to reduce taxes is to ask the retailer to reduce the declared amount of the item purchased or better yet, ask them to declare it as $20 CAD or less.

The best courier is the United States Postal Service (USPS) which transfers to Canada Post. They do not charge any customs fees/broker fees.

Once you know the steps, it’s much easier than you think.

Yes, there’s a nifty tool called Canada Tariff Finder that you can use.

If you don’t pay the DHL custom fees, the package will eventually be returned back to the sender.

What you should read next

Travel Resources For Your Next Trip

If you’re in the process of planning your trip and putting together your itinerary, these are genuinely the best resources that the Going Awesome Places team stands by 100%.

Credit cards: Don’t get burned by hidden fees on top of terrible exchange rates. When we travel now, we use the Wise Card. Simply load it with the currency you need before you go and use it as a regular VISA or their digital wallet card. Use their free app to track how much you have and top up when you need to.

Flights: Of all the booking search engines, Skyscanner is the most helpful and easy to use thanks to their Everywhere feature. Kayak is also another that’s we will often check as well.

Car Rental: If you’re looking to save money, these car rental coupon codes will be a true game-changer. Otherwise, DiscoverCars and RentalCars are great places to start.

Airport Parking: You’ll need a spot to leave your car at the airport so why not book a spot at a discount. Use code AWESOME7 to get at least $5 off at Airport Parking Reservations or Park Sleep Fly packages.

Data: We’ve been a huge fan of wifi hotspot devices like PokeFi because their rates are so good and you can use it globally but recently, we’ve really loved using eSIMs. The best one is Airalo. Save money by getting region-specific eSIMs and use referral code WILLIA9500 to get $3 USD credit on your first purchase. Ubigi is another one that we’ve had success with where they uniquely offer 5G coverage. Use code AWESOME10 to save 10% on your first order.

Hotels: Our go-to is Booking.com because they have the best inventory of properties including hotels and B&Bs plus they have their Genius tier discounts. The exception is Asia where Agoda always has the best prices. TripAdvisor is also useful for reviews and bookings.

Vacation Rentals: Your first instinct will be to check Airbnb but we always recommend checking VRBO as well if you’re looking for a vacation rental.

Tours: When planning our trips, we always check both Viator and GetYourGuide to at least see what’s out there in the destination that we’re going to. They often have different offerings and prices so check both.

Travel Insurance: Learn how to buy the best travel insurance for you. This isn’t something you want to travel without.

- Insured Nomads – Popular insurance provider for frequent travelers and comes with great coverage and special perks.

- RATESDOTCA – Search engine Canadians looking for the cheapest insurance including multi-trip annual policies.

- SafetyWing – A perfect fit for long-term nomads.

- Medjet – Global air medical transportation.

- InsureMyTrip – Best for seniors, families, and those with pre-existing conditions.

If you need more help planning your trip, make sure to check out our Travel Toolbox where we highlight all of the gear, resources, and tools we use when traveling.