If you’re like me, you love to travel and seek new experiences. More often than not though, those popular activities are considered to be high-risk and dangerous enough that they’re actually not covered by Canadian travel insurance.

Wait so you’re saying that activities such as ATV-ing, hot air ballooning, scuba diving, sea kayaking, and horseback riding aren’t covered even if you have travel insurance? The answer is most likely no. This is why you need to know which Canadian travel insurance actually includes extreme sports.

Read more travel tips

- Best Canadian credit cards for travel hackers

- How to roll your clothes – an essential travel skill

- 6 minimalist travel tips

- How does Travelzoo work and are they legit?

How to get the best deals in travel

- Hottest deals – Bookmark the travel deals page.

- Car rentals – stop getting ripped off and learn about car rental coupon codes.

- Hotels – Use corporate codes or get Genius 2 tier with Booking.

- Flights – Have you ever heard of the “Everywhere” feature?

- Insurance – Make sure you’re covered and learn more about where to buy the best travel insurance.

In This Article

Canadian Travel Insurance For Extreme Sports

When it comes to Canadian travel insurance, it’s complicated like every other insurance product. They’re designed to be ambiguous, hard to find, and hard to compare.

“When I buy travel insurance as a Canadian, how do I know if I’m covered for extreme sports that I plan on doing when I’m on the road?”

So let’s cut to the chase and find out what policy out there is actually good for the Canadian traveller that wants to do some adventure and extreme sports.

Why Canadians should care about extreme sports

For those with an adventurous spirit, some activities might come up in your trip planning that are a little more adrenaline pumping than some of the others.

If you had to think twice about whether you should do it or not, or whether your friends, partner, or parents would approve, it’s probably an “extreme sport”.

A lot of it deepnds on where you’re going of course.

On our recent trip to New Zealand, it should be no surprise to you that we were encountering extreme sports everywhere from skydiving near Abel Tasman, wreck diving to see the famed Rainbow Warrior, and cave tubing to see the glow worms.

All of those were incredible experiences but was I covered by my travel insurance?

Yes, but only because I bought the right one.

What’s considered to be extreme sports for travel insurance?

So the term extreme sports is really just a more laymans’s term for something the insurance industry calls “high-risk activities”.

When you look at Canadian travel insurance policies, these are the sports that are most often NOT covered.

- Bungee Jumping

- Black water rafting

- Caving

- Canyoning

- Diving

- Jet Boating

- Jet-skiing

- Kitesurfing

- Mountain Climbing

- Parachuting

- Paragliding

- Parasailing

- Parkour

- Rock Climbing

- Ziplining

- Hang-gliding

- Scuba diving (except if certified by internationally recognized and accepted programs such as NAUI or PADI, or if the diving depth does not exceed 30 metres)

- White water rafting (except grades 1 to 4 – for reference, most on the Ottawa River with OWL Rafting is in this range)

Now that’s an extensive list.

The only good news is that if you’re scuba diving certified, what you’re doing is not considered to be extreme. Some insurance companies do allow white water rafting of grades 1 to 4 which is what most operators like OWL Rafting do.

If you then start thinking about some things that may or may not be mentioned like Running of the Bulls, shark cage diving we did in South Africa, or even those ice climbing/glacier walk experiences in Iceland, you’re most likely not covered by your travel insurance policy no matter how little the deductible is or how expensive it is.

What you should look for in Canadian travel insurance?

Well that’s great. You’ve just learned that most insurance policy doesn’t cover any of the really fun activities when you travel.

Before I reveal the best Canadian travel insurance for extreme sports is, let’s just cover some of the basics in what to look for in a travel insurance policy.

- Type of policy – Single trip? Multi-trip? Annual?

- What is covered – Lost/stolen luggage? Personal liability? Pre-existing medical conditions? Cancellations? Delays? Extreme sports and sports insurance coverage?

- Exclusions – What is in the fine print? Are all countries covered?

- Deductible – How much do you have to pay in order to make a claim?

- Coverage amounts – How much in total are you covered? 10 million? 2 million? For specific instances, what is the coverage (i.e. car rental, meals, and other things called incidentals)

I have a more comprehensive guide coming soon but just from these few bullet points alone, your head is probably spinning.

Personally, I think the big reason why insurance is complicated is because there are too many choices. There’s no centralized place to look for them. Yes, RATESDOTCA tries to but their interface is clunky and it doesn’t really show you everything.

Most importantly, I still can’t believe there’s no travel insurance search engine that can just tell you which one covers extreme sports.

Does credit card insurance cover you for extreme sports?

No.

Every premium credit card, including the ones I mention in the best cards for travel hackers, is going to include good travel insurance but they never include “high risk activities”.

My take? Credit cards can be handy for the one-off “low-risk” trips. However, if you really just want the comfort of having care-free comprehensive coverage then an insurance policy is the best investment.

Where can you buy Canadian travel insurance that includes extreme sports?

I’ve done the leg work and have gone through what RATESDOTCA offers and I’ve jumped from one complicated underwriter’s page to another.

It’s a deep rabbit hole that I wouldn’t wish on any of you.

Ultimately, there’s seriously only one company that lays it out to Canadians straight and its World Nomads.

Who is World Nomads

Luckily, I have a full review of the World Nomads travel insurance product and whether it’s worth it or not but here’s what you need to know:

- Founded in 2002 by Australian Simon Monk.

- Built on the principle of providing insurance that’s travellers actually need and want.

- Covers travel to over 150 countries, includes medical and evacuation cover, provides 24-hour emergency assistance, and covers a wide range of adventure and extreme sports activities.

- Well-known in the travel community for their work in responsible travel, travel guides, and workshops.

- Sells travel insurance globally and does this by partnering with country-specific underwriters.

Extreme sports coverage

What I love about World Nomads is that they aren’t afraid to publish what’s included and what isn’t when it comes to extreme sports.

They lay it all out and the level of detail is quite incredible.

To name a few, here are some extreme sports that even I was impressed World Nomads includes.

- Hot air ballooning

- Bungee jumping

- Camel trekking

- Dog sledding

- Elephant trekking

- Horseback riding

- Sea Kayaking

- Rock climbing outdoors under 6,000m

- Mountain biking

- Skydiving (one jump only but still!)

- Paragliding

- Scuba diving to 30m (this is PADI open water diver limits)

- Shark cage diving

- Skiing/Snowboarding

- Whitewater rafting

- Canyoning

It’s so comprehensive and relevant that you probably won’t find an extreme sport activity that isn’t on the list.

You’ll notice that associated to each activity is a level in the range 1 to 3. By default, whether you get the Standard or Explorer Plan, all level 1 activities are included.

If you need coverage for Level 2 or Level 3 activities, you need to add-on additional coverage.

How are sports covered by World Nomads

So great, these sports are on a list of allowed activities while travelling. How does that actually translate to coverage?

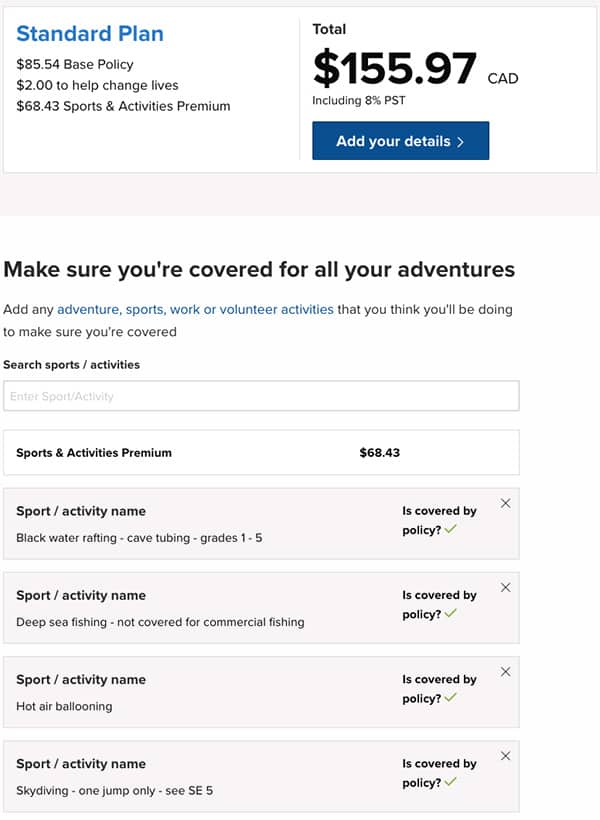

The below is what a sample 2 week trip to Peru for a 30-year-old looks like:

The price is the Standard Plan is $86 CAD and Explorer Plan is $102 CAD. Both plans include Level 1 extreme sports coverage.

To add all Level 2 extreme sports activities, there’s an extra cost of $38.49 CAD. If you want Level 3 to be included, it’s $68.43 CAD.

Note that all prices mentioned here include tax.

Of course, there are other differences in the policy which I cover in my review of World Nomads travel insurance (coming soon), but from an activities standpoint, that’s what the differences in the plans mean.

How to get a quote with World Nomads

If you’re still in the process of shopping around or just want to know what to expect cost-wise for travel insurance, you can get a quote that includes specific extreme sports you’re thinking about by doing the following steps:

Step 1 – Start by getting your initial quote by filling out your details from the link below.

Step 2 – Select your plan (Standard or Explorer Plan)

Step 3 – On this page, you’ll have to explicitly pick what extreme sports you’re interested in.

This is basically looking for whether you’ll be doing Level 2 and Level 3 activities.

If all of your activities are Level 1, no cost will be added. You will be charged whatever your highest level of activity you have on the list. So for example, if you have one Level 3 activity and a few Level 2 activities, it’ll charge you the Level 3 add-on rate for your trip.

Step 4 – Look on the right hand side and see a summary of your travel insurance. You can also enter your e-mail address to the quote emailed to you.

Why I was really annoyed with TuGo

While I honestly had trouble finding other insurance providers that had more clear definitions of extreme or high-risk activities, I did find TuGo.

At first I was excited that I found another Canadian travel insurance company that are more forward about extreme sports but once I dove into getting a quote, I found myself incredibly frustrated.

Yes, it’s great that it’s highly customizable but I found myself really struggling to choose the emergency medical amounts. It was at this point that I realized that it’s really hard to choose between $2 million, $5 million, $100 million, or something in between.

Once I got to the sports add-on, I had to search for the various activities I’d be doing on a trip but it wasn’t clear whether I needed to have all activities selected for coverage or whether it would work like the “level system” that World Nomads has.

Lastly was the cost. By simply adding skydiving and scuba over 40 metres, you’re looking at an extra cost of $151.80 CAD for the exact same trip I was quoting with World Nomads. That’s more than double the cost of the Level 2 and 3 add-on.

Bottom line

#1 Get travel insurance. #2 Make sure extreme sports are covered.

Trying to find a Canadian travel insurance company that includes extreme sports is like trying to find a needle in the haystack. And when you do find it, they make you jump through hoops to add it in or force you to pay a ransom amount.

Save yourself the headache and just go with World Nomads.

If you think there’s the remote possibility of doing an outdoor activity that is considered to be an extreme sport, make sure you’re covered before you leave home.

Frequently asked questions

Without a doubt, it’s World Nomads. They have the most thorough list of activities, sports, and adventures for Canadians and at the most reasonable price.

You’ll notice that on the list of extreme sports that snowboarding is on there but only the advanced variants. To clear this up, basic snowboarding within resort boundaries isn’t considered to be extreme and thus included in all plans. That said, what isn’t covered are stunts and tricks so you’re on your own if you use the terrain park.

If you pay attention to the extreme sports page on World Nomads, you’ll see that this Level 3 activity only includes 1 jump. If you plan doing more than 1 tandem skydive, you won’t be covered.

Currently, there’s only World Nomads, TuGo, and Ingle that have special extreme sports coverage.

Unfortunately most travel insurance policies don’t cover any competition-based sports and that would include training as well.

Scuba diving up to 30m is considered to be Level 1 for World Nomads which is included in all plans. If you plan on diving own to 40m, a Level 3 add-on is required.

As long as the rock climbing is under 6,000m in height outdoors, you’re covered but this is considered to be a Level 3 extreme sport which is an extra add-on with World Nomads.

With World Nomads, quad biking is a Level 1 extreme sport which is included in either of their Standard or Explorer plans.

What’s been your experience with Canadian travel insurance and extreme sports? I’d love to hear your stories. Just drop a comment below!

Travel Resources For Your Next Trip

If you’re in the process of planning your trip and putting together your itinerary, these are genuinely the best resources that the Going Awesome Places team stands by 100%.

Credit cards: Don’t get burned by hidden fees on top of terrible exchange rates. When we travel now, we use the Wise Card. Simply load it with the currency you need before you go and use it as a regular VISA or their digital wallet card. Use their free app to track how much you have and top up when you need to.

Flights: Of all the booking search engines, Skyscanner is the most helpful and easy to use thanks to their Everywhere feature. Kayak is also another that’s we will often check as well.

Car Rental: If you’re looking to save money, these car rental coupon codes will be a true game-changer. Otherwise, DiscoverCars and RentalCars are great places to start.

Airport Parking: You’ll need a spot to leave your car at the airport so why not book a spot at a discount. Use code AWESOME7 to get at least $5 off at Airport Parking Reservations or Park Sleep Fly packages.

Data: We’ve been a huge fan of wifi hotspot devices like PokeFi because their rates are so good and you can use it globally but recently, we’ve really loved using eSIMs. The best one is Airalo. Save money by getting region-specific eSIMs and use referral code WILLIA9500 to get $3 USD credit on your first purchase. Ubigi is another one that we’ve had success with where they uniquely offer 5G coverage. Use code AWESOME10 to save 10% on your first order.

Hotels: Our go-to is Booking.com because they have the best inventory of properties including hotels and B&Bs plus they have their Genius tier discounts. The exception is Asia where Agoda always has the best prices. TripAdvisor is also useful for reviews and bookings.

Vacation Rentals: Your first instinct will be to check Airbnb but we always recommend checking VRBO as well if you’re looking for a vacation rental.

Tours: When planning our trips, we always check both Viator and GetYourGuide to at least see what’s out there in the destination that we’re going to. They often have different offerings and prices so check both.

Travel Insurance: Learn how to buy the best travel insurance for you. This isn’t something you want to travel without.

- Insured Nomads – Popular insurance provider for frequent travelers and comes with great coverage and special perks.

- RATESDOTCA – Search engine Canadians looking for the cheapest insurance including multi-trip annual policies.

- SafetyWing – A perfect fit for long-term nomads.

- Medjet – Global air medical transportation.

- InsureMyTrip – Best for seniors, families, and those with pre-existing conditions.

If you need more help planning your trip, make sure to check out our Travel Toolbox where we highlight all of the gear, resources, and tools we use when traveling.